Series context. Parts A and B established the “why”: Africa needs decision tools that don’t just simulate carbon—they simulate real life. We argued for world-model-class simulations governed for public purposes (Part A). We demonstrated, through the Afram Plains case, how adoption behavior can significantly impact outcomes in clean energy transitions (Part B). Part C is the “how.” It proposes an AI-enabled Integrated Platform (AIIP) that implements a comprehensive modeling cascade – enabling planners, investors, regulators, and communities to view the same system, make trade-offs explicit, and transition from pilots to portfolios.

Generalizing Afram Plains. While our running example drew from Ghana’s Afram Plains, the platform is designed to be portable across Africa—from Sahelian mini-grids to peri-urban clean-cooking transitions and grid-interactive commercial and industrial (C&I) sites—by modularizing data inputs, behaviors, policy levers, and financial structures.

The Capability Gap We Must Close

Over the course of the Afram Plains assessment, i benchmarked an early version of TinyWorld Africa (TWA) and adjacent tooling against what decision-makers actually need. The bottom line: we’re strong on “where” and “what,” weak on “who, when, and under what rules and money.” That gap is precisely where projects stall.

Integrated Modeling Capability Assessment Table

| Challenge Domain | Current TWA Capabilities | Critical Gaps | Impact of Gap |

| GIS/Geospatial (Infrastructure Planning) | Strong: Settlement mapping, terrain analysis, accessibility modeling, grid extension cost estimation | Minor gaps in real-time data integration | Low — existing capabilities adequate |

| Techno‑Economic (System Design) | Moderate: Basic sizing calculations, component cost databases | Integration with real-time pricing; limited optimization algorithms | Medium — can be addressed with plug‑ins |

| Agent‑Based (Adoption & Demand) | Weak: Static demand assumptions; no behavioral modeling | Cannot model social diffusion, peer effects, cultural factors, or adoption dynamics | HIGH — leads to systematic overestimation of subscription rates |

| Financial Viability (Business Case) | Absent: No dynamic financial modeling capability | Cannot assess cash flow, NPV, IRR, tariff sensitivity, or risk scenarios over time | CRITICAL — investors cannot assess viability or compare financing structures |

| System Dynamics / Policy (Governance) | Absent: No policy scenario engine | Cannot simulate regulatory changes, subsidies, or governance pathways; cannot quantify uncertainty | CRITICAL — policy uncertainty remains unquantified, deterring investment |

The last two rows of the Table matter most. Why? Without dynamic finance and policy/system dynamics, everyone prices in risk or walks away. Techno-economic tools, such as LEAP’s recently developed Energy Modeling Assistant, have raised the bar for energy planning workflows. However, they still fall short of what our decisions require: dynamic cash-flow viability (IRR/NPV, tariff, and risk stress tests) and a policy/system-dynamics core that captures feedback and governance pathways. TinyWorlds Africa model is being designed from the ground up to close precisely these two gaps. As explained below, the design of TWA for AISESA addresses the urgent need for credible adoption curves, cash flow physics, and rule-of-the-game scenarios. Otherwise, we reenact the very coordination failures we intend to fix.

Afram Plains as proof. A detailed review of electrification challenges in the Afram plains, including recent conversations with Wisdom Ahiataku-Togobo, confirms one thing: while most existing tools can generate technically viable options for decision-makers, these options often end up as financial non-starters once realistic adoption and tariff stress tests are applied. That’s not a corner case; it’s the default when behavior and rules are exogenous.

Modeling Cascade for AISESA (Proposed Architecture)

Components (annotated)

- GIS / Geospatial — Who lives where, how they move, what it costs to reach them.

- Techno-Economic — What to build at what size and cost.

- Agent-Based Demand — Who actually adopts, when, and how peers influence peers.

- Financial Viability — Cashflows (NPV/IRR), tariff stress tests, risk ladders.

- Policy / System Dynamics — What happens under different subsidies, standards, or governance pathways?

- Decision Support — Rank portfolios, show trade-offs, document uncertainty, and contingencies.

- Data & M&E feedback — Real-world telemetry and surveys tune the next planning cycle.

What TWA Adds (Beyond Today’s Tooling)

- Behavioral realism. Built-in agent-based adoption modules that learn from social diffusion, liquidity frictions, and seasonal incomes.

- Finance as a first-class citizen — dynamic cashflow engines with Monte-Carlo risk analysis; tariff and subsidy stress tests.

- Policy inside the model, not post-hoc. Levers for VAT exemptions, appliance standards, connection fees, transition grants — quantified and comparable.

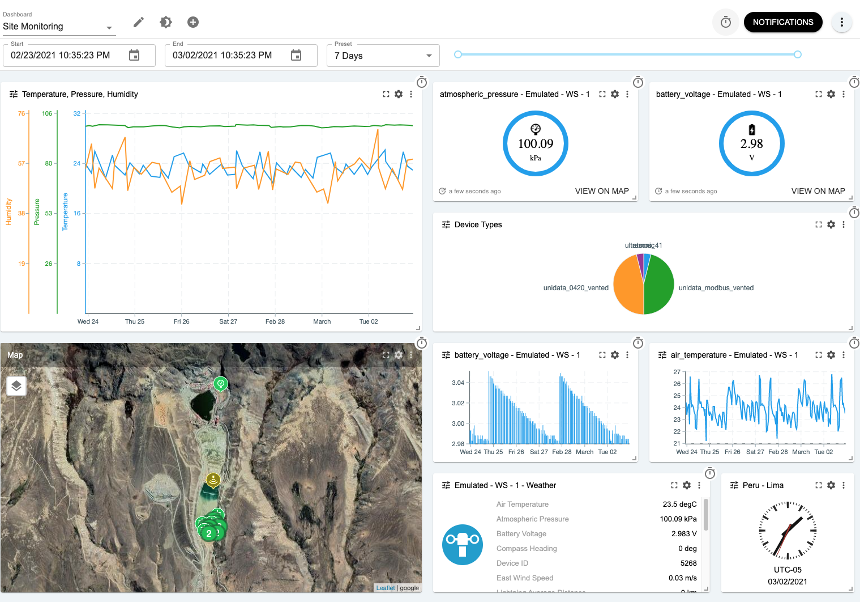

- One shared pane of glass. Developers, regulators, financiers, and community reps read the same dashboards, debate assumptions, not PDFs.

- Learning loop. Telemetry and audits close the gap between plan and reality — fast.

A Suggestion: Implementation Roadmap (24 Months)

Phase 1 (0–6 months): Integrate GIS + Techno-economic + basic ABM; run five Afram Plains proofs to validate inputs and outputs.

Phase 2 (7–12 months): Add dynamic finance + policy/system-dynamics; co-test with Ghana Energy Commission and three developers.

Phase 3 (13–18 months): Train ML on historical projects, natural-language queries, automated reporting, and portfolio ranking.

Phase 4 (19–24 months): Scale beyond the Afram Plains; integrate real-time monitoring; develop a mobile UI for the field team; package for other countries.

Governance & Trust

- Transparent assumptions: Every slider logged, every scenario reproducible.

- Open interfaces: Import/export for regulators and DFIs; clear data-protection boundaries.

- Responsible defaults: “Default to use; escalate verification with stakes”—meaning we model broadly, then dial up scrutiny when a decision moves money or affects people.

Call to Action

For AISESA — and for Africa’s energy future — my point isn’t prettier diagrams. It’s bankable, governable decisions that scale. The cascade above gives us a practical path from diagnosis to action. We’ve started building it. We can go far by creating it together.